Financial Data Visualization - Amounts

This article is part of financial data visualization series where we cover most prominent plots used to quickly comprehend thousands or even millions of data points to support decision-making in finance. In this article, we dive deeper into visualizing amounts in finance.

Although, both can be used to visualize numeric data; the purpose is a lot different. The purpose of visualizing amounts is to compare magnitude of discrete numeric data over time or any other categorical variable. Bar plots and Line plots are excellent ways to visualize amounts. The length of the bar is proportional to the magnitude of the discrete numeric variable.

In this article, we cover some of the more common visualizations used to represent amounts (i.e. magnitude of the quantitative values)

1. Bar Charts

2. Diverging Bar Charts

3. Stacked Bar Charts

4. Grouped Bar Charts (also called Clustered Bar Charts)

5. Animated Bar Charts

6. Dot Plots (also called Cleveland Dot Charts)

7. Bubble Charts

8. Heatmaps

Others include :

9. Waterfall Charts

10. Polar Area Charts (also called Coxcomb Charts)

11. Dumbbell Charts

We will be using quandl api and quantmod api to import financial data. Using an API for importing data is beneficial, especially in finance, because the dataset is updated extremely frequently, and they offer a lot of benefits in terms of ease and flexibility.

We can install quandl & quantmod packages and register an account on quandl.com

Create a free Quandl account and set your API key here

For more information, refer to the link below :

https://www.quandl.com/tools/r

# Run the script below with your secret key obtained after registering on quandl

# quandl_sk = "<quandl secret key>"

# Alternative way to Load Data Tokens

source("../R/Setup/apitokens.r")

# Data manipulation libraries used in this notebook

library(tibble) # includes rownames_to_column function

library(dplyr) # includes filter function

library(tidyr) # includes spread function

# Visualization libraries used in this notebook

library(ggplot2) # Includes ggplot function

library(ggforce) # Includes geom_sina & geom_parallel_sets

library(ggridges) # Includes geom_

library(cowplot) # Includes axis_canvas for generating A Canvas Onto Which One Can Draw Axis-Like Objects

# Data API libraries

library(Quandl) # To import data from Quandl API

library(quantmod) # To import data using yahoo,google api

# Animation Packages

library(gganimate) # to add animation to static plot

library(gifski) # Converts images to GIF animations

library(png) # Provides an easy and simple way to read, write and display bitmap images stored in the PNG format.

# Datetime Parsing functions

library(lubridate) # includes datetime parsing functions

# Data visualization addon library for Themes and colors available in my github repository

# https://github.com/prabhupavitra/dviz.addon

library(dviz.addon)

# Resizing plot width and height from default 7

# https://www.rdocumentation.org/packages/repr/versions/0.7/topics/repr-options

options(repr.plot.width=10, repr.plot.height=4)

Importing Data (Using Quandl and quantmod API)

This notebook uses Quandl and quantmod API to import Financial Data directly to R.

Datasets used in this notebook include:

1. Historical Prices of Precious Metals (Gold, Silver, Platinum and Palladium)

2. Historical Prices of Non-Ferrous Base Metals (Aluminum; Copper; Lead; Nickel; Tin and Zinc)

3. Consumer Price Index for All Urban Consumers (CPI-U)

Precious Metals Prices : London Fixing (U.S. Dollars per Troy Ounce)

# Using Quandl API : Import prices of Precious Metals ( Gold, Silver, Platinum, Palladium )

# Gold Price: London Fixing

gold <- Quandl("LBMA/GOLD", api_key=quandl_sk)

# Silver Price: London Fixing

silver <- Quandl("LBMA/SILVER", api_key=quandl_sk)

# Platinum Fixing

platinum <- Quandl("LPPM/PLAT", api_key=quandl_sk)

# Palladium

palladium <- Quandl("LPPM/PALL", api_key=quandl_sk)

Base Metals Prices : Spot Prices (U.S. Dollars per metric ton)

# Other Base Metals (Aluminum; Cobalt; Copper; Iron Ore; Lead; Molybdenum; Nickel; Tin; Uranium and Zinc)

# Aluminum; 99.5% minimum purity; LME spot price; CIF UK ports; US$ per metric ton

aluminium <- Quandl("ODA/PALUM_USD", api_key=quandl_sk)

# Copper; grade A cathode; LME spot price; CIF European ports; US$ per metric ton

copper <- Quandl("ODA/PCOPP_USD", api_key=quandl_sk)

# Lead; 99.97% pure; LME spot price; CIF European Ports; US$ per metric ton

lead <- Quandl("ODA/PLEAD_USD", api_key=quandl_sk)

# Nickel; melting grade; LME spot price; CIF European ports; US$ per metric ton

nickel <- Quandl("ODA/PNICK_USD", api_key=quandl_sk)

# Tin; standard grade; LME spot price; US$ per metric ton

tin <- Quandl("ODA/PTIN_USD", api_key=quandl_sk)

# Zinc; high grade 98% pure; US$ per metric ton

zinc <- Quandl("ODA/PZINC_USD", api_key=quandl_sk)

CPI Data : CPI for U.S. City Average (Units: Index 1982-1984=100, Seasonally Adjusted ; Frequency: Monthly)

# Consumer Price Index for All Urban Consumers: All Items in U.S. City Average

monthly_allitems <- Quandl("FRED/CPIAUCSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Food and Beverages in U.S. City Average

monthly_foodbev <- Quandl("FRED/CPIFABSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average

monthly_excfoodnbev <- Quandl("FRED/CPILFESL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Recreation in U.S. City Average

monthly_recreation <- Quandl("FRED/CPIRECSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Housing in U.S. City Average

monthly_housing <- Quandl("FRED/CPIHOSNS", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Education and Communication in U.S. City Average

monthly_eduncomm <- Quandl("FRED/CPIEDUSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Apparel in U.S. City Average

monthly_apparel <- Quandl("FRED/CPIAPPSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Energy in U.S. City Average

monthly_energy <- Quandl("FRED/CPIENGSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Other Goods and Services in U.S. City Average

monthly_othergns <- Quandl("FRED/CPIOGSSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Transportation in U.S. City Average

monthly_trnsprt <- Quandl("FRED/CPITRNSL", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Services in U.S. City Average

monthly_otherserv <- Quandl("FRED/CUSR0000SAS", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Commodities in U.S. City Average

monthly_commod <- Quandl("FRED/CUSR0000SAC", api_key=quandl_sk)

# Consumer Price Index for All Urban Consumers: Medical Care in U.S. City Average

monthly_medcare <- Quandl("FRED/CPIMEDSL", api_key=quandl_sk)

Data Preparation

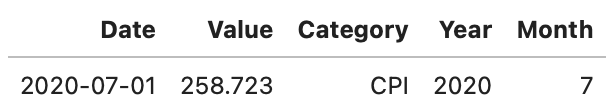

Precious Metals Prices : London Fixing (U.S. Dollars per Troy Ounce)

# Merging the datasets of all 4 precious metals (Measured per Troy Ounce)

precious_metals <-

rbind(gold %>% select("Date","USD (AM)") %>% rename(USD="USD (AM)") %>% mutate(Commodity="Gold"),

silver %>% select("Date","USD") %>% mutate(Commodity="Silver"),

platinum %>% select("Date","USD AM") %>% rename(USD="USD AM") %>% mutate(Commodity="Platinum"),

palladium %>% select("Date","USD AM") %>% rename(USD="USD AM") %>% mutate(Commodity="Palladium")) %>%

mutate(Year = year(Date)) %>% filter(USD!="NA")

head(precious_metals,5)

Base Metals Prices : Spot Prices (U.S. Dollars per metric ton)

base_metals <-

rbind(aluminium %>% mutate(Commodity="Aluminium"),

copper %>% mutate(Commodity="Copper"),

lead %>% mutate(Commodity="Lead"),

nickel %>% mutate(Commodity="Nickel"),

tin %>% mutate(Commodity="Tin"),

zinc %>% mutate(Commodity="Zinc")) %>%

mutate(Year = year(Date))

head(base_metals,1)

CPI Data : CPI for U.S. City Average

cpi_monthly_sa <-

rbind(monthly_allitems %>% mutate(Category="CPI"),

monthly_excfoodnbev %>% mutate(Category="Core CPI"),

monthly_apparel %>% mutate(Category="Apparel"),

monthly_commod %>% mutate(Category="Commodities"),

monthly_eduncomm %>% mutate(Category="Education & Communication"),

monthly_energy %>% mutate(Category="Energy"),

monthly_foodbev %>% mutate(Category="Food & Beverages"),

monthly_housing %>% mutate(Category="Housing"),

monthly_medcare %>% mutate(Category="Medical Care"),

monthly_othergns %>% mutate(Category="Other Goods & Services"),

monthly_otherserv %>% mutate(Category="Other Services"),

monthly_recreation %>% mutate(Category="Recreation"),

monthly_trnsprt %>% mutate(Category="Transportation")) %>%

mutate (Year =year(Date),Month=month(Date))

head(cpi_monthly_sa,1)

Before we proceed with visualizations, we will calculate some commonly used CPI metrics

# Percent Change (1982-Present)

cpi_pctchng <- filter(cpi_monthly_sa,#Month==1,

Year>1982,

!(Category %in% c('Energy','Transport'))) %>%

group_by(Category) %>%

arrange(Date) %>%

mutate(PercentChange = (Value/lag(Value)-1)*100) %>%

filter(PercentChange!="NA")

# Over-the-year percent change

cpi_otypct <-

cpi_monthly_sa %>%

filter(Year>1982,Month==12) %>%

arrange(Date) %>%

group_by(Category) %>%

mutate(OverYrPercentChange = (Value/lag(Value)-1)*100) %>%

filter(OverYrPercentChange!="NA")

# Annual Average, Annual Average CHange and Purchasing Power

cpi_annualavg <-

cpi_monthly_sa %>% filter(Year>1982,Year<2020) %>%

arrange(Date) %>%

group_by(Year,Category) %>%

summarise(AnnualAvg = mean(Value)) %>%

group_by(Category) %>%

mutate(AnnualAvgChange = (AnnualAvg/lag(AnnualAvg)-1)*100,

PurchasingPower = (AnnualAvg/lag(AnnualAvg)*100)) %>%

filter(AnnualAvgChange!="NA")

Bar Charts

A simple way to visualize the quantitative data of a categorical variable is the bar chart. The height of the bar is proportional to the quantity we want to visualize. They can be used for displaying data that are classified as nominal data/ordinal data.

They are one of the most commonly used types of plots because they are simple to create and very easy to interpret. They are also a flexible chart type and there are several variations of the standard bar chart.

Most commonly used bar charts include:

- Horizontal bar charts

- Diverging bar charts

- Grouped or Component charts

- Stacked bar charts

- Animated bar charts

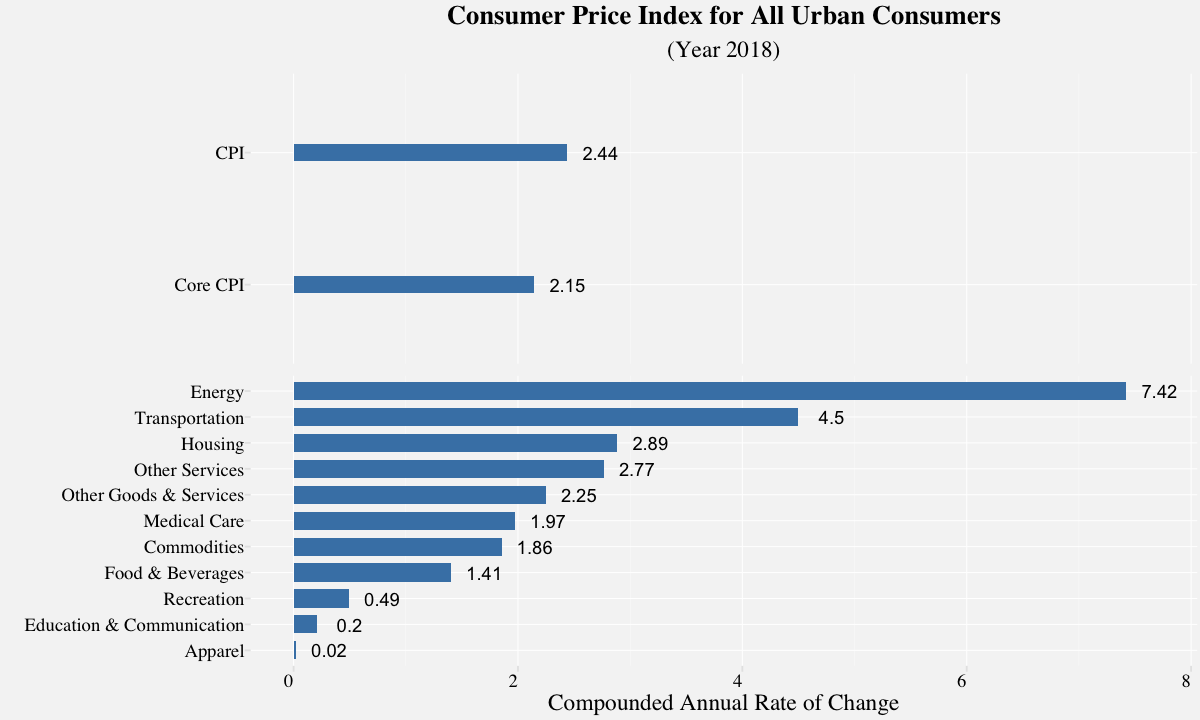

We will go through each one of these bar charts to get a sense of efficacy bar charts have in visualizing amounts. We will use CPI data for plotting horizontal, diverging and animated bar charts and metal prices for the others.

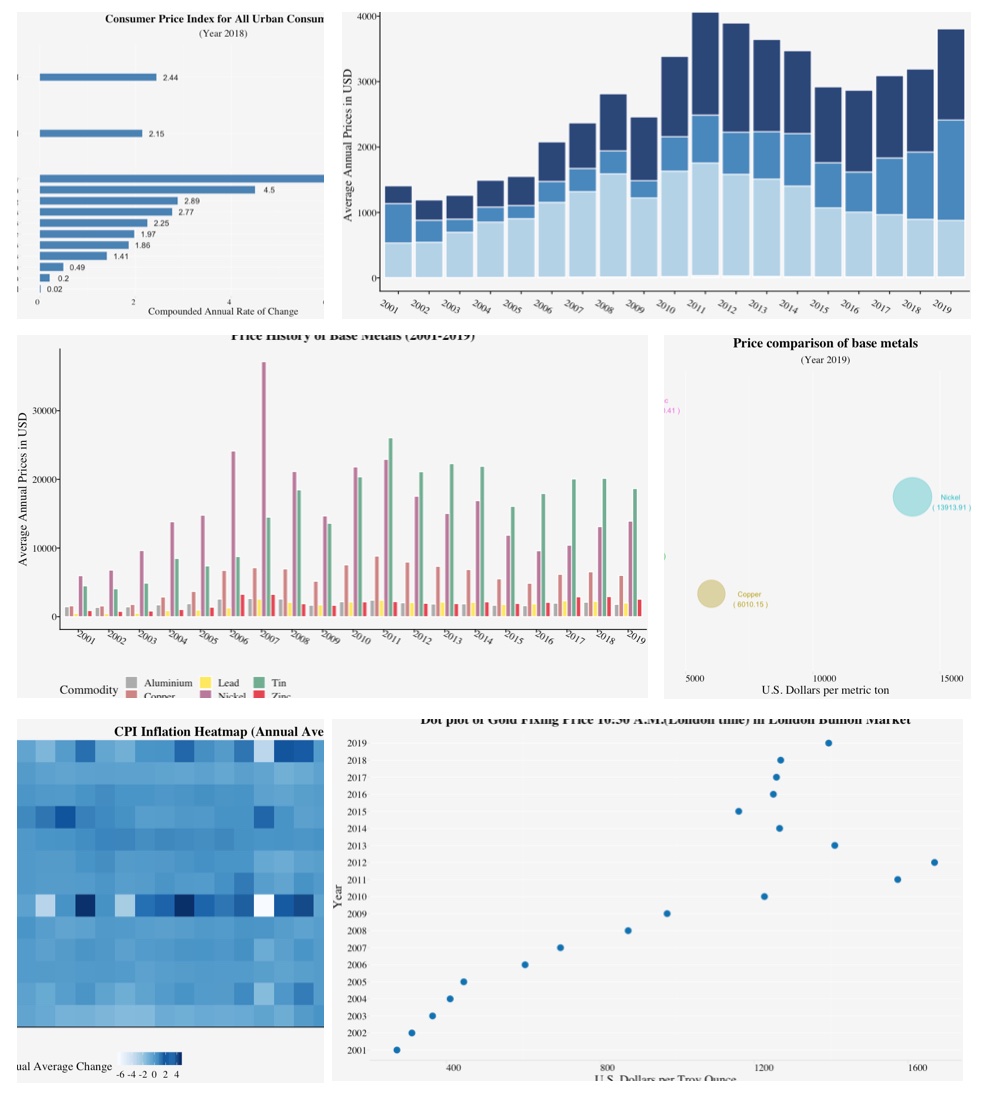

Horizontal bar chart

# Resizing the plot

options(repr.plot.width=10, repr.plot.height=6)

# Subset of Consumer Price Index for All Urban Consumers for the year 2018

df_barplot_categories <- filter(cpi_annualavg,

Year==2018,

!Category %in% c('CPI','Core CPI')) %>%

mutate(plotorder = 1)

df_barplot_all <- filter(cpi_annualavg,

Year==2018,

Category %in% c('CPI','Core CPI')) %>%

mutate(plotorder = 0)

# Plotting the bar plot

barplot_cpi <-

ggplot(size=20) +

geom_bar(data=df_barplot_categories,

aes(x=reorder(Category,AnnualAvgChange),

y=AnnualAvgChange),

stat="identity",

width= 0.7,

fill="steelblue") +

geom_bar(data = df_barplot_all,

aes(x = reorder(Category,plotorder),y=AnnualAvgChange),

stat="identity",

width=0.125,

fill="steelblue") +

geom_text(data=df_barplot_categories,

aes(x=reorder(Category,AnnualAvgChange),

y=(AnnualAvgChange+ 0.25 * sign(AnnualAvgChange)),

label =paste(" ",round(AnnualAvgChange,2))),

hjust=0.5) +

geom_text(data=df_barplot_all,

aes(x = reorder(Category,plotorder),

y= (AnnualAvgChange+ 0.25 *sign(AnnualAvgChange)),

label =paste(" ",round(AnnualAvgChange,2))),

hjust=0.5) +

theme_pprabhu_grid() +

labs(title = "Consumer Price Index for All Urban Consumers",

subtitle="(Year 2018)",

x="",

y="Compounded Annual Rate of Change") +

coord_flip() +

theme(plot.title = element_text(hjust = 0.5),

plot.subtitle = element_text(hjust = 0.5,size=14),

axis.text.x = element_text(angle=0,hjust = 1),

strip.text.x = element_blank()) +

facet_wrap(.~plotorder, nrow = 2,scales="free_y",shrink = FALSE)

barplot_cpi

Diverging bar chart

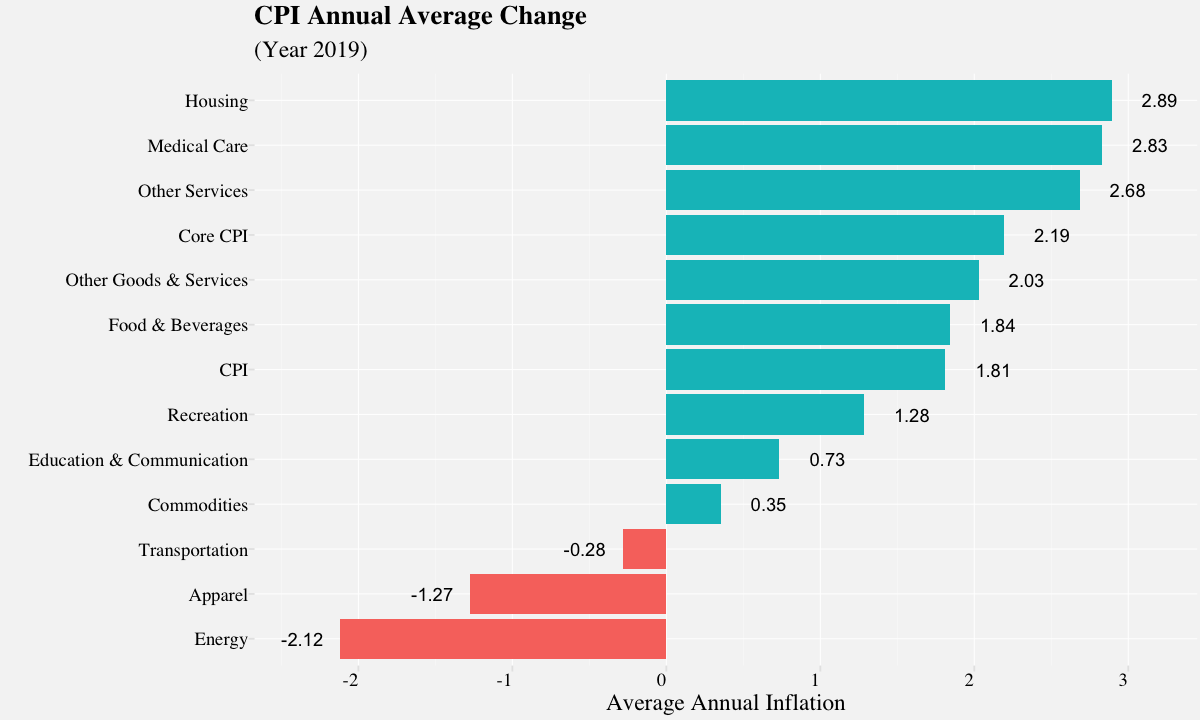

A diverging bar chart is a bar chart with a diverging aspect; i.e. It makes comparison of amounts from a divergent line easy to visualize. This divergent line can represent zero, but it can also be used to simply separate the two distinguishing members of the dataset based on the amount.In the plot depicted below, the divergent line is zero; Its quite easier to visualize which Categories saw a positive rate of inflation vs negative.

# Diverging bar plot

cpi_annual <- cpi_annualavg %>% filter(Year==2019)

# Plotting the diverging bar plot

barplot_cpiannual <-

ggplot(cpi_annual,

aes(x=reorder(Category,AnnualAvgChange),

y=AnnualAvgChange,

fill = AnnualAvgChange>0))+

geom_bar(stat="identity")+

geom_text(aes(x=reorder(Category,AnnualAvgChange),

y=(AnnualAvgChange+ 0.28 * sign(AnnualAvgChange)),

label =paste(" ",round(AnnualAvgChange,2))),

hjust=0.5) +

labs(x="",

y="Average Annual Inflation",

title ="CPI Annual Average Change",

subtitle="(Year 2019)") +

theme_pprabhu_grid() +

coord_flip() +

theme(plot.subtitle = element_text(size=14),

axis.text.x = element_text(angle = 0, hjust = 1)) +

guides(fill = FALSE)

barplot_cpiannual

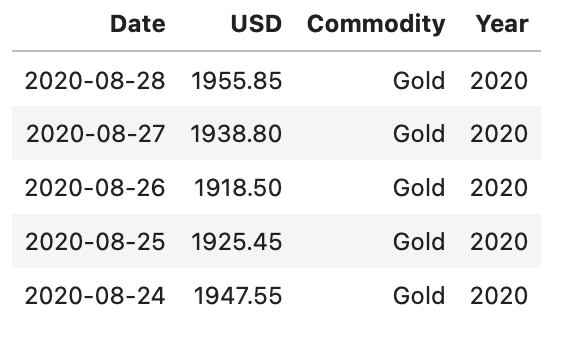

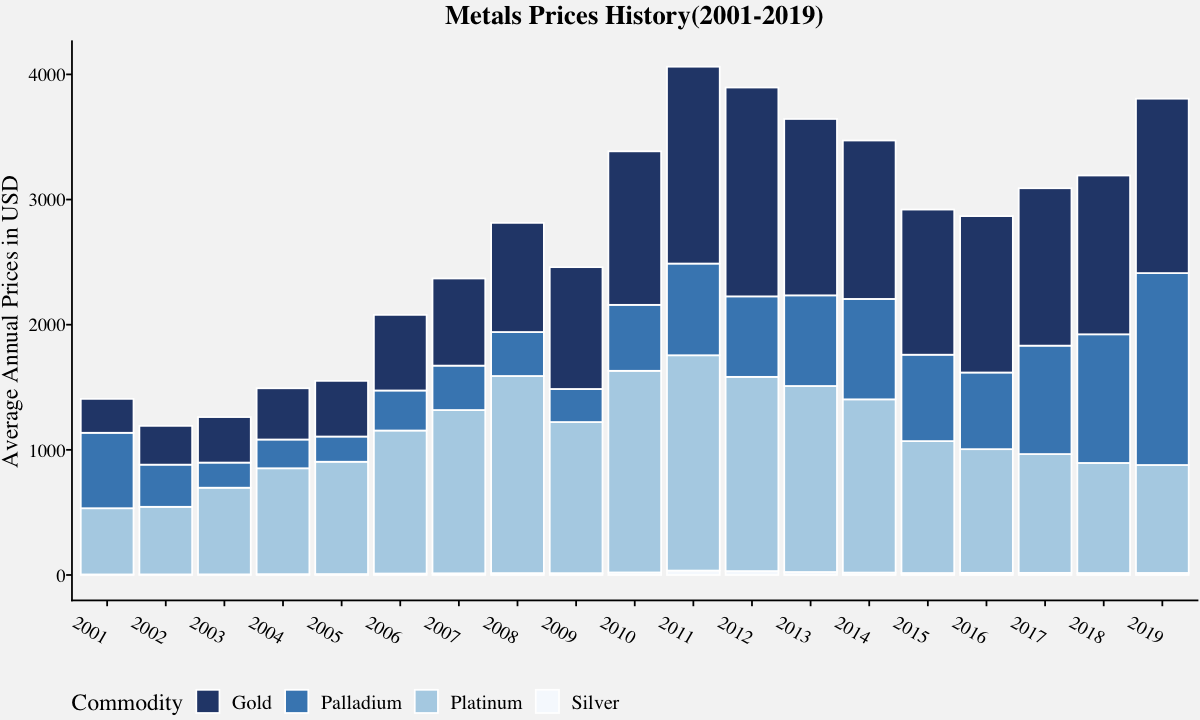

Stacked bar chart

The stacked bar chart extends the standard bar chart from visualizing quantity of one categorical variable to two. Each bar in a standard bar chart is divided into a number of sub-bars stacked end to end, each one corresponding to a level of the second categorical variable. The main objective of a standard bar chart is to compare numeric values between levels of a categorical variable. It also visualizes relative decomposition of each of the categories.

The stacked bar chart below depicts historical annual prices of precious metals. The two categorical variables: Commodity and Year. The primary categorical variable is the Commodity. It also depicts the relative decomposition of each of the commodities. For example, we can compare prices of 2018 vs 2019 in the stacked bar chart and infer that although the prices of gold, platinum and silver were steady, the palladium prices have risen considerably.

# Annual Metal prices (Includes Gold, Silver, Platinum and Palladium)

metals_stacked <- filter(precious_metals,!is.na(USD),Year<2020,Year>2000) %>%

group_by(Year,Commodity) %>%

summarise(AnnualPrice = round(mean(USD),2))

# Plot the stacked barplot using geom_bar()

metals_stackedplot <-

ggplot(data=metals_stacked,

aes(x=factor(Year),

y=AnnualPrice,

fill=Commodity)) +

geom_bar(stat="identity",

color="white",

alpha=0.9) +

labs(x="",y="Average Annual Prices in USD") +

ggtitle("Metals Prices History(2001-2019)") +

theme_pprabhu() +

theme(plot.title = element_text(hjust = 0.5),

axis.text.x = element_text(hjust = 1)) +

scale_fill_pprabhu(palette = "sseq",discrete=TRUE)

metals_stackedplot

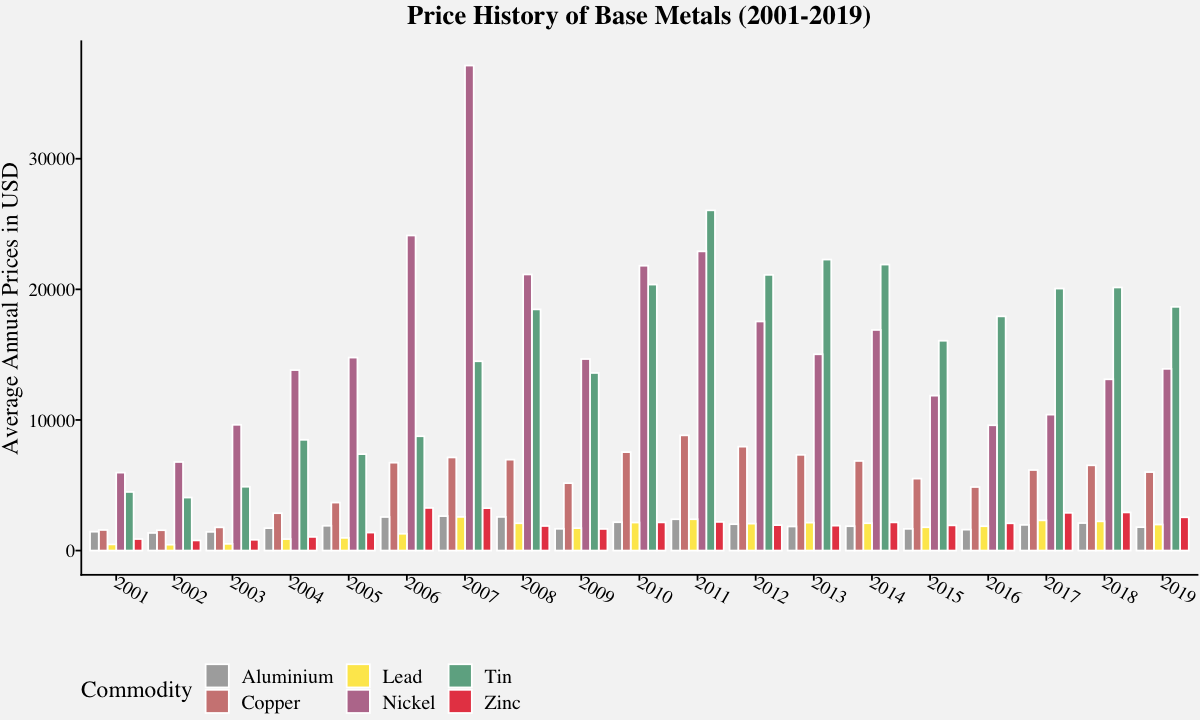

Grouped bar chart

The grouped bar chart, also known as clustered bar graph, multi-set bar chart, or grouped column chart is a variation of bar chart used when we need to visualize distribution of data points or making comparisons across different categories of data.

They are used when you want to do within-group and between-group comparisons in one single plot. For example, in the plot below, we can check the price comparisons of base metals within each year as well as over a period of time.

# Grouped Bar plot using geom_bar()

metals_grouped <- filter(base_metals,!is.na(Value),Year<2020,Year>2000) %>%

group_by(Year,Commodity) %>%

summarise(AnnualPrice = round(mean(Value),2))

metals_groupedplot <-

ggplot(data=metals_grouped, aes(x=factor(Year),

y=AnnualPrice,

fill=Commodity)) +

geom_bar(stat="identity",

position=position_dodge(),

alpha=0.8,

color="white") +

labs(x="",y="Average Annual Prices in USD") +

ggtitle("Price History of Base Metals (2001-2019)") +

scale_fill_pprabhu(palette = "qual") +

theme_pprabhu() +

theme(plot.title = element_text(hjust = 0.5))

metals_groupedplot

Animated bar chart

Animated bar charts are mostly used for visualization of trends over time. They provide a holistic data story/insight in a concise and easy to understand chart, which makes them more popular in social media.

# Creating a Animated Bar Chart using ggplot and geom_tile

cpi_input_format <-

cpi_annualavg %>%

group_by(Year)%>%

mutate(rank = rank(-AnnualAvgChange),

Value_rel = AnnualAvgChange/AnnualAvgChange[rank==1],

Value_lbl = paste0(" ",round(AnnualAvgChange,2))) %>%

group_by(Category) %>%

filter(rank <= 10)

# Creates images for every year

anim <-

ggplot(cpi_input_format,

aes(rank, group = Category))+

geom_tile(aes(y = AnnualAvgChange/2,

height = AnnualAvgChange,

fill = AnnualAvgChange>0,

width = 0.9), alpha = 0.8) +

geom_text(aes(y =sign(AnnualAvgChange)-4,

label = paste(Category, " ")),

vjust = 0.2,

hjust = 1,

size=7) +

geom_text(aes(y=(AnnualAvgChange+ 0.45 * sign(AnnualAvgChange)),

label =paste(" ",round(AnnualAvgChange,2))),

hjust=0.5,

size=7) +

coord_flip(clip = "off",

expand = TRUE) +

scale_x_reverse() +

theme_pprabhu() +

theme(legend.position="none",

plot.margin = margin(1,4, 1, 8, "cm"),

axis.line=element_blank(),

axis.text.x=element_blank(),

axis.text.y=element_blank(),

axis.title.x=element_blank(),

axis.title.y=element_blank()) +

transition_states(Year, transition_length = 4, state_length = 1) +

ease_aes('cubic-in-out') + # For a smoother look

labs(title = 'CPI Annual Average by Category: {closest_state}')

# Stores the gif_image object in the working directory

animate(anim, nframes = 350,

fps = 15,

width = 1200,

height = 1000,

renderer = gifski_renderer("gganim.gif"))

# This line inserts the image inline

IRdisplay::display_png(file = "gganim.gif")

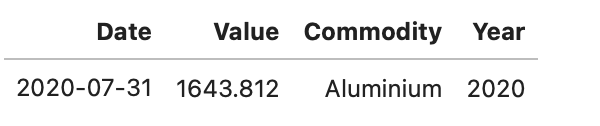

Cleveland Dot Plots

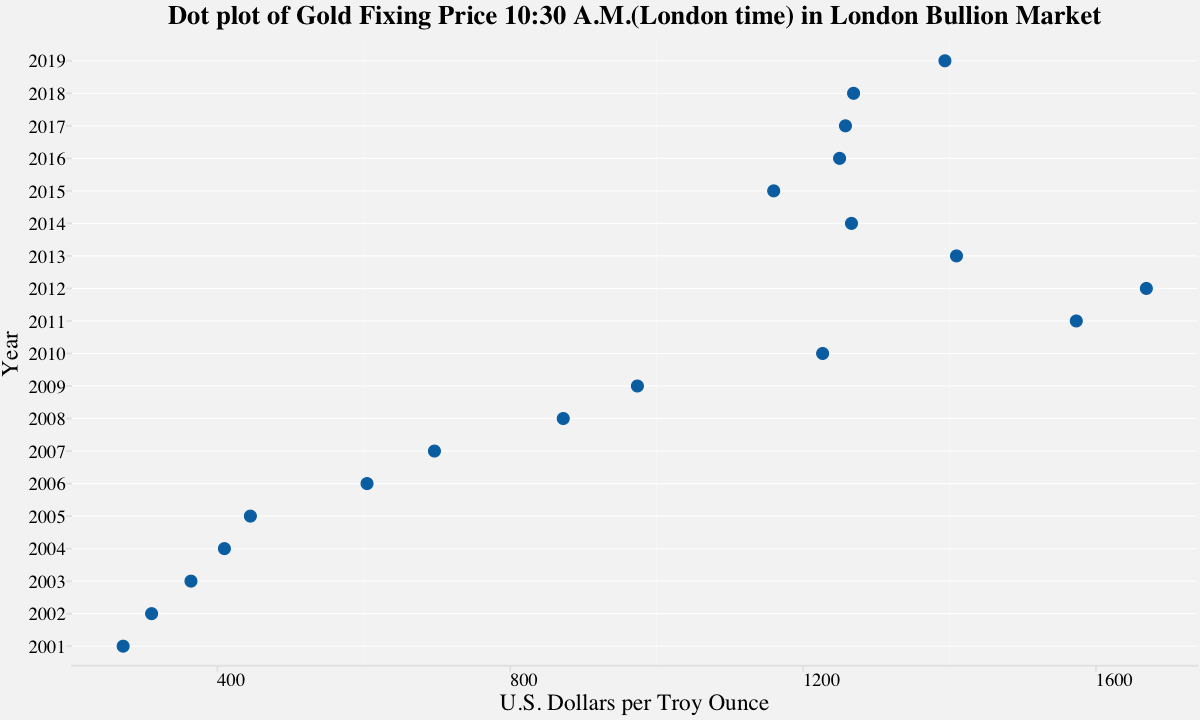

Dot plots are one of the simplest way to visualize single numerical variable with a modest number of observations. Cleveland dot plots refer to plots of points that each belong to one of several categories. They are an alternative to bar charts or pie charts, and look somewhat like a horizontal bar chart where the bars are replaced by a dots at the values associated with each category. They are a great alternative to the bar chart and the power of these plots becomes evident on refining and they can easily communicate important aspects of your data to viewers. In the example below, we have considered depicting Gold fixing price. Although this is a simple and basic case of dot plot, they are capable of depicting lot more information.

dotplot_data <- filter(precious_metals,Commodity=="Gold",!is.na(USD),

Year<2020,

Year>2000) %>%

group_by(Year) %>%

summarise(AnnualPrice = mean(USD))

# Dot plot using geom_point()

gold_dotplot <-

ggplot(data=dotplot_data,

aes(x = as.character(Year),y=AnnualPrice)) +

geom_point(color = "#0072B2", size = 3) +

labs(x="Year",y="U.S. Dollars per Troy Ounce") +

ggtitle("Dot plot of Gold Fixing Price 10:30 A.M.(London time) in London Bullion Market") +

theme_pprabhu_hgrid() +

theme(plot.title = element_text(hjust = 0.5),

axis.text.x = element_text(angle=0)) +

coord_flip()

gold_dotplot

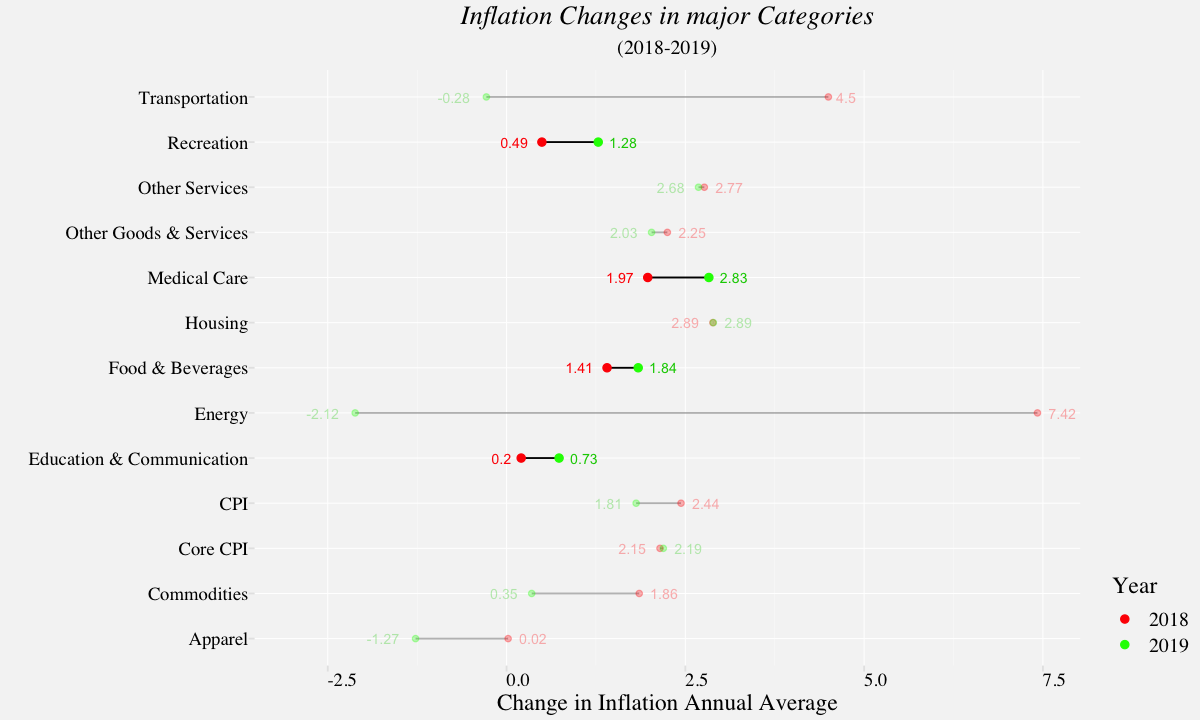

In the above example, we have considered depicting Gold fixing price. Although this is a simple and basic case of dot plot, they are capable of depicting lot more information. In the next example, we use dot plot to visualize the rate of inflation from 2018 to 2019 and highlight the categories which underwent more than 20% rise in inflation rate.

# Creating a data frame that identifies inflation changes over 20%

cpi_diff <- filter(cpi_annualavg,Year %in% c('2018','2019')) %>%

select(Year,Category,AnnualAvgChange) %>%

spread(Year,AnnualAvgChange) %>%

rename(Year_2019=3,Year_2018=2) %>%

group_by(Category) %>%

mutate(Diff = Year_2019 / Year_2018 - 1) %>%

arrange(desc(Diff)) %>%

filter(Diff > .2)

# Creating a data frame for labels

labels_df <- filter(cpi_annualavg,Year %in% c('2018','2019')) %>%

select(Year,Category,AnnualAvgChange) %>%

spread(Year,AnnualAvgChange) %>%

rename(Year_2019=3,Year_2018=2) %>%

group_by(Category) %>%

mutate(left_label = min(Year_2018,Year_2019),

right_label = max(Year_2018,Year_2019)) %>%

mutate(left_Year=if_else(left_label==Year_2018,"2018","2019"),

right_Year=if_else(right_label==Year_2018,"2018","2019"))

left_labels <- select(labels_df,"Category","left_label","left_Year")

right_labels <- select(labels_df,"Category","right_label","right_Year")

# Creating the main data frame for dot plot

df_cpi <- select(labels_df,"Category","Year_2018","Year_2019") %>%

gather(Year,AnnualAvgChange,-Category)

# Filtering main data frame to including Categories where the inflation changes exceeds 20%.

highlight <- filter(df_cpi,Category %in% cpi_diff$Category)

# Plots dot plot showing changes in CPI from 2018-2019 in all major categories

cpi_dualdotplot <-

ggplot(df_cpi,aes(x = df_cpi$AnnualAvgChange,y=df_cpi$Category)) +

geom_line(aes(group = Category), alpha = .3) +

geom_point(aes(color = Year), size = 1.5, alpha = .3) +

geom_line(data = highlight,

aes(x = highlight$AnnualAvgChange,

y=highlight$Category,

group = Category)) +

geom_point(data = highlight,

aes(x = highlight$AnnualAvgChange,

y=highlight$Category,

color = Year),

size = 2) +

geom_text(data=left_labels,

aes(x= left_labels$left_label,

y= left_labels$Category,

label = round(left_labels$left_label, 2)),

color=left_labels$left_Year,

alpha= if_else(right_labels$Category %in% highlight$Category,1,0.3),

size = 3,

hjust = 1.5) +

geom_text(data=right_labels,

aes(x= right_labels$right_label,

y= right_labels$Category,

label = round(right_labels$right_label, 2)),

color=right_labels$right_Year,

size = 3,

alpha = if_else(right_labels$Category %in% highlight$Category,1,0.3),

hjust = -.4) +

theme_pprabhu_grid() +

scale_colour_manual(

values = c("red","green"),

breaks = c("Year_2018", "Year_2019"),

labels = c("2018", "2019")) +

labs(title="Inflation Changes in major Categories",

subtitle="(2018-2019)",

x="Change in Inflation Annual Average",

y="") +

theme(legend.position="right",

legend.justification = c("right", "bottom"),

legend.margin = margin(5, 5, 5, 5),

axis.text.x = element_text(angle=0),

plot.title=element_text(hjust=0.5,face = "italic"),

plot.subtitle=element_text(hjust=0.5)) +

xlim(-3,7.5)

cpi_dualdotplot

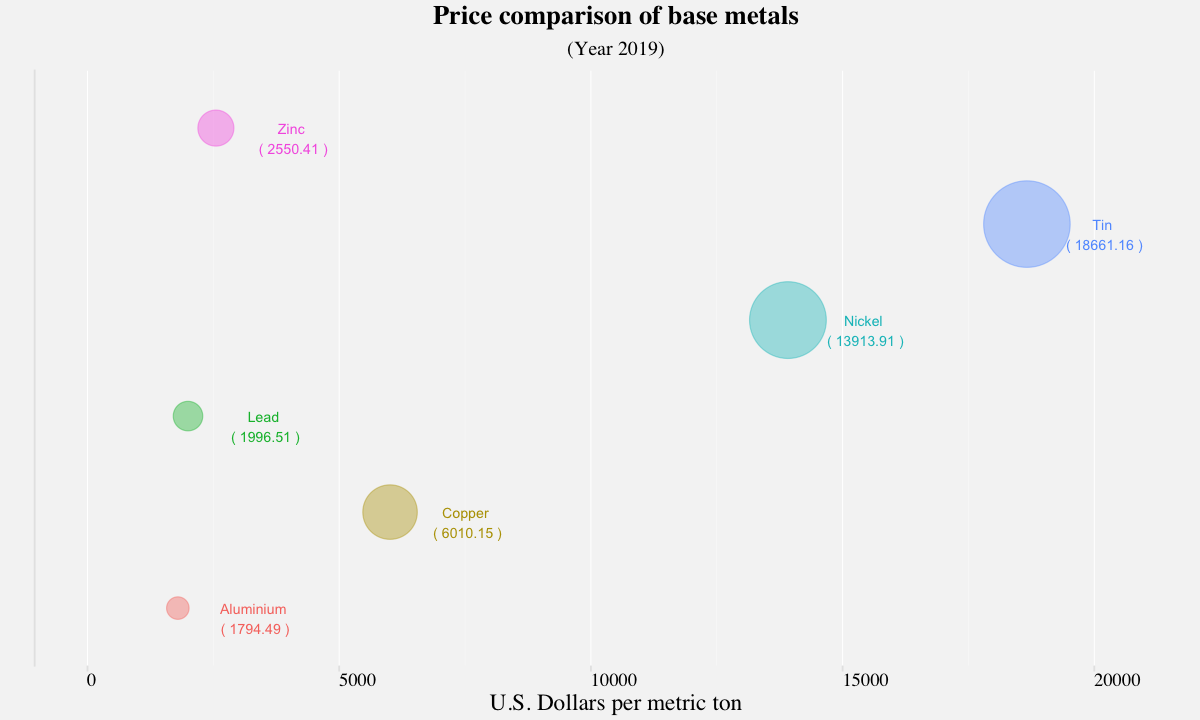

Bubble Chart

A bubble chart uses areas of circle to represent the quantity of a numeric variable. It is a preferred when we want to represent relationship between two or more numeric variables. In the following example, we represent the prices of base metals for the year 2019.

bubble_df <- base_metals %>%

filter(base_metals$Year==2019) %>%

group_by(Commodity) %>%

summarise(AnnualPrice = round(mean(Value),2))

basemetals_bubbleplot <-

ggplot(bubble_df,aes(x=AnnualPrice,

y=Commodity,

color = Commodity,

size=AnnualPrice)) +

geom_point(aes(size=AnnualPrice),alpha=0.4) +

scale_size(range = c(6, 24),

name="Annual Price") +

geom_text(aes(x=AnnualPrice+1500,

y = Commodity,

label=paste("\n",Commodity,"\n","(",AnnualPrice,")")),

size=3) +

labs(title="Price comparison of base metals",

subtitle="(Year 2019)",

x="U.S. Dollars per metric ton",

y="") +

xlim(0,21000)+

theme_pprabhu_vgrid() +

guides(color=FALSE,size=FALSE) +

theme(axis.text.y = element_blank(),

axis.ticks.y = element_blank(),

axis.text.x = element_text(angle=0),

plot.title = element_text(hjust=0.5),

plot.subtitle = element_text(hjust=0.5))

basemetals_bubbleplot

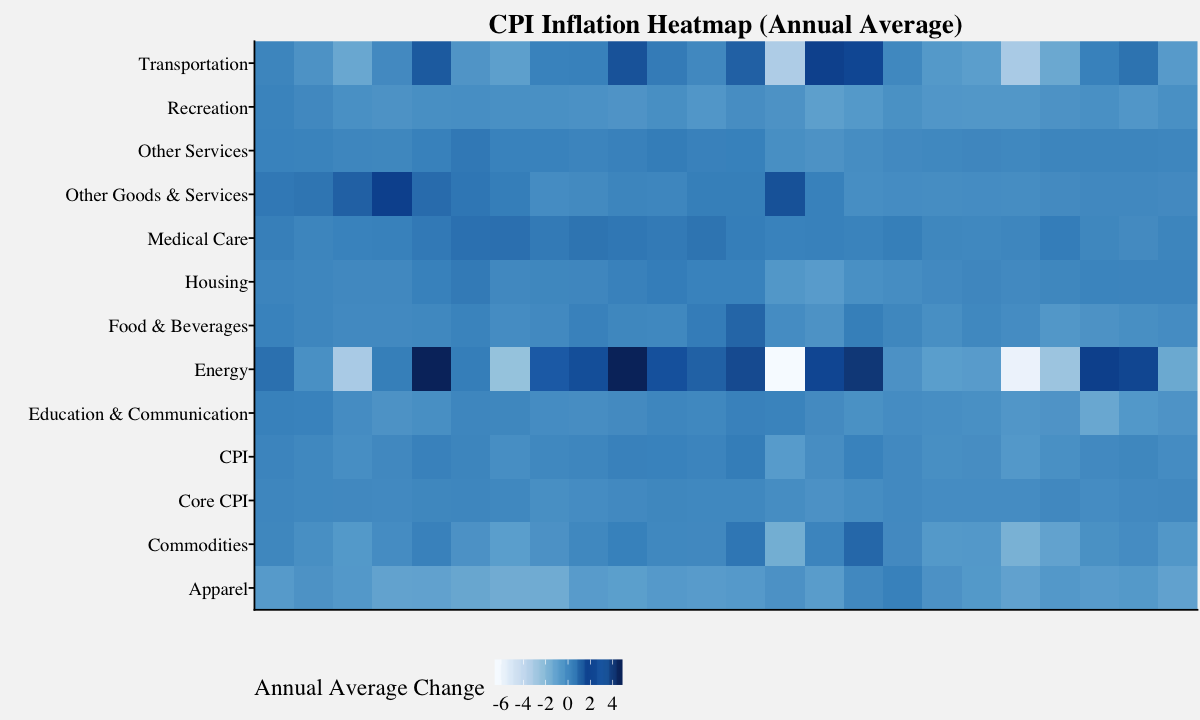

Heatmap

A heatmap depicts values for a main variable of interest across two axis variables as a grid and uses color coding to represent the quantity of values. In the below example, we generate a heatmap to depict historic monthly change in rate of inflation for major categories.

# Plots the heatmap on the CPI monthly Percent Change data

heatmap_plot <-

ggplot(data=filter(cpi_annualavg,Year>1995),

aes(x=Year,

y=Category,

fill=scale(AnnualAvgChange))) +

geom_tile(size=0.35,

aes(fill = scale(AnnualAvgChange))) +

labs(x="",

y="",

fill = "Annual Average Change") +

ggtitle("CPI Inflation Heatmap (Annual Average)") +

scale_x_discrete(expand = c(0, 0)) +

scale_y_discrete(expand = c(0, 0)) +

theme_pprabhu() +

scale_fill_pprabhu(palette = "sseq",

discrete=FALSE,

reverse = FALSE) +

theme(plot.title = element_text(hjust = 0.5,vjust=-0.5),

axis.text.x = element_text(angle=0),

legend.position="bottom",

legend.direction = "horizontal")

heatmap_plot

Thanks for reading! As I mentioned in the beginning, there are a lot of cool visualization techniques available for visualizing amounts. To modify the visualizations with your own data, Click Colab Notebook to edit and run the workbook using Google Colab. If you want to get in touch with me, feel free to reach me on my email. You can also view the code in my Github repository .